-

Thanh toán đa dạng, linh hoạtChuyển khoản ngân hàng, thanh toán tại nhà...

Thanh toán đa dạng, linh hoạtChuyển khoản ngân hàng, thanh toán tại nhà... -

Miễn Phí vận chuyển 53 tỉnh thànhMiễn phí vận chuyển đối với đơn hàng trên 1 triệu

Miễn Phí vận chuyển 53 tỉnh thànhMiễn phí vận chuyển đối với đơn hàng trên 1 triệu -

Yên Tâm mua sắmHoàn tiền trong vòng 7 ngày...

Yên Tâm mua sắmHoàn tiền trong vòng 7 ngày...

Trading and Investing for Beginners: Stock Trading Basics, High level Technical Analysis, Risk Management and Trading Psychology (Trading and Investing Course: Advanced Technical Analysis)

-

- Mã sản phẩm: B09PP2WC1K

- (64 nhận xét)

- ASIN:B09PP2WC1K

- Publisher:Independently published (January 4, 2022)

- Language:English

- Paperback:343 pages

- ISBN-13:979-8793792448

- Item Weight:1.12 pounds

- Dimensions:6 x 0.78 x 9 inches

- Best Sellers Rank:#225,624 in Books (See Top 100 in Books) #301 in Investment Analysis & Strategy #335 in Stock Market Investing (Books) #737 in Introduction to Investing

- Customer Reviews:4.4 out of 5 stars 62Reviews

Mô tả sản phẩm

From the Publisher

Do you want to make money trading the stock market?

In this book I tell you everything you need to Trading in the financial markets and start getting profitability from your savings.

The 3 factors you need to become a winning trader or investor

1. Building a winning investment strategy

In this book you will learn 4 different types of winning trading strategies that you can implement depending on the market context.

2. Implement solid risk management

You will apply robust money management strategies and discover advanced techniques for managing trades.

3. Maintain an appropriate market psychology.

You will build a statistical and objective mindset, accepting that the market is an environment of uncertainty in which anything can happen at any time.

Save Time, Effort and Money

Learn about Stock Markets

You will discover all the knowledge you need to understand how financial markets work: Market characteristics - Main investment products - Fundamental concepts and financial jargon

We will study 3 Technical Analysis methodologies whose underlying logic is based on the study of the interaction between supply and demand: Prlce Action - Volume Spread Analysis - Wyckoff Methodology.

In this book you will learn...

- Advanced Financial Education Concepts

- How financial markets work

- 4 Winning Trading Strategies

- Robust risk management strategies

- To build a statistical and objective mindset

- How to create a Trading Plan from scratch

- Where and How to Search for Investment Ideas

You will learn 3 methodologies of Technical Analysis based on the study of the interaction between supply and demand:

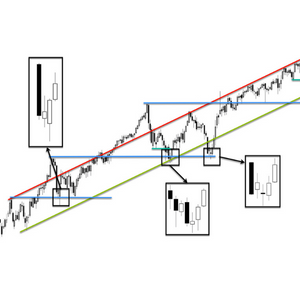

PRlCE ACTION

Through the study of PRlCE ACTION we will learn to identify the context in order to select the type of trading that best suits it.

As we know, markets can only be in two states: range and trend.

Volume Spread Analysis

The VSA methodology identifies the intervention or absence of large traders: when they are entering or exiting, as well as the degree of interest and participation they show in the movements.

Wyckoff Method

The Wyckoff method focuses on the study of ranges. It tries to elucidate which force is in control and where the next move is most likely to be.

In addition, thanks to the events and phases that compose it, it gives us a much more defined context and roadmap of what to expect the market to do.

|  |  | |

|---|---|---|---|

| Trading and Investing for beginners | The Wyckoff Methodology in Depth | Wyckoff 2.0: Structures, Volume Profile and Order Flow | |

| Content difficulty | Basic | Intermediate | Advanced |

| Who is this book for? | Interested in starting from scratch to take their first steps in the financial markets. Also for fundamental analysts who want to have a real approach to technical analysis. | Technical analysts who want to specialize in a methodology whose principles are based on the study of the real driving force: the interaction between supply and demand. | Experienced traders who want to improve the quality of their trading by studying advanced tools such as Volume Profile and Order Flow. |

| Why do you need this knowledge? | Simply because it is your only option. In this book we will lay the foundations of the knowledge you will need to trade the markets from scratch with the greatest chance of success. | It is essential to know what the major institutional traders are doing. In this book we will learn to identify their intervention and to position ourselves alongside them. | In this book you will learn advanced knowledge about the way financial markets work, which will allow you to improve your trading considerably. |

| Why this book and not another? | The advantage of this book is that it will save you time, effort and money. I have been down that road myself and I know exactly what you need to know and how best to explain it so that it is understood. | This book is the result of years of research and operations, refining the concepts of the methodology and adapting them to the way today's markets work. | There is simply no book like it. It is content that is not even offered in trading courses that cost a great deal of money. You will learn how to use tools created by and for professional traders. |

| Key concepts you will learn | Advanced Financial Education, Fundamentals of Stock Trading, High-Level Technical Analysis, Risk Management, Emotional Management, Business Management and Practical Section | How Markets Move, The 3 Fundamental Laws, The Processes of Accumulation and Distribution, Structures, Events and Phases; as well as Advanced Concepts of the Wyckoff Methodology. | The current trading ecosystem, Auction Market Theory, Order Matching, Volume Profile Strategies, Order Flow Patterns, Combination Wyckoff Structures + Trading Principles with Value Areas |

- Mua astaxanthin uống có tốt không? Mua ở đâu? 29/10/2018

- Saffron (nhụy hoa nghệ tây) uống như thế nào cho hợp lý? 29/09/2018

- Saffron (nghệ tây) làm đẹp như thế nào? 28/09/2018

- Giải đáp những thắc mắc về viên uống sinh lý Fuji Sumo 14/09/2018

- Công dụng tuyệt vời từ tinh chất tỏi với sức khỏe 12/09/2018

- Mua collagen 82X chính hãng ở đâu? 26/07/2018

- NueGlow mua ở đâu giá chính hãng bao nhiêu? 04/07/2018

- Fucoidan Chính hãng Nhật Bản giá bao nhiêu? 18/05/2018

- Top 5 loại thuốc trị sẹo tốt nhất, hiệu quả với cả sẹo lâu năm 20/03/2018

- Footer chi tiết bài viết 09/03/2018

- Mã vạch không thể phân biệt hàng chính hãng hay hàng giả 10/05/2023

- Thuốc trắng da Ivory Caps chính hãng giá bao nhiêu? Mua ở đâu? 08/12/2022

- Nên thoa kem trắng da body vào lúc nào để đạt hiệu quả cao? 07/12/2022

- Tiêm trắng da toàn thân giá bao nhiêu? Có an toàn không? 06/12/2022

- Top 3 kem dưỡng trắng da được ưa chuộng nhất hiện nay 05/12/2022

- Uống vitamin C có trắng da không? Nên uống như thế nào? 03/12/2022

- [email protected]

- Hotline: 0909977247

- Hotline: 0908897041

- 8h - 17h Từ Thứ 2 - Thứ 7

Đăng ký nhận thông tin qua email để nhận được hàng triệu ưu đãi từ Muathuoctot.com

Tạp chí sức khỏe làm đẹp, Kem chống nắng nào tốt nhất hiện nay Thuoc giam can an toan hiện nay, thuoc collagen, thuoc Dong trung ha thao , thuoc giam can LIC, thuoc shark cartilage thuoc collagen youtheory dau ca omega 3 tot nhat, dong trung ha thao aloha cua my, kem tri seo hieu qua, C ollagen shiseido enriched, và collagen shiseido dạng viên , Collagen de happy ngăn chặn quá trình lão hóa, mua hang tren thuoc virility pills vp-rx tri roi loan cuong duong, vitamin e 400, dieu tri bang thuoc fucoidan, kem chống nhăn vùng mắt, dịch vụ giao hang nhanh nội thành, crest 3d white, fine pure collagen, nên mua collagen shiseido ở đâu, làm sáng mắt, dịch vụ cho thue kho lẻ tại tphcm, thực phẩm tăng cường sinh lý nam, thuoc prenatal bổ sung dinh dưỡng, kem đánh răng crest 3d white, hỗ trợ điều trị tim mạch, thuốc trắng da hiệu quả giúp phục hồi da. thuốc mọc tóc biotin

KHUYẾN MÃI LỚN

KHUYẾN MÃI LỚN Hỗ Trợ Xương Khớp

Hỗ Trợ Xương Khớp Bổ Não & Tăng cường Trí Nhớ

Bổ Não & Tăng cường Trí Nhớ Bổ Sung Collagen & Làm Đẹp

Bổ Sung Collagen & Làm Đẹp Bổ Thận, Mát Gan & Giải Độc

Bổ Thận, Mát Gan & Giải Độc Chăm Sóc Sức khỏe Nam Giới

Chăm Sóc Sức khỏe Nam Giới Chăm Sóc Sức khỏe Nữ Giới

Chăm Sóc Sức khỏe Nữ Giới Chăm sóc Sức khỏe Trẻ Em

Chăm sóc Sức khỏe Trẻ Em Thực Phẩm Giảm Cân, Ăn Kiêng

Thực Phẩm Giảm Cân, Ăn Kiêng Bổ Sung Vitamin & Khoáng Chất

Bổ Sung Vitamin & Khoáng Chất Bổ Tim Mạch, Huyết Áp & Mỡ Máu

Bổ Tim Mạch, Huyết Áp & Mỡ Máu Bổ Mắt & Tăng cường Thị lực

Bổ Mắt & Tăng cường Thị lực Điều Trị Tai Mũi Họng

Điều Trị Tai Mũi Họng Sức Khỏe Hệ Tiêu hóa

Sức Khỏe Hệ Tiêu hóa Chăm Sóc Răng Miệng

Chăm Sóc Răng Miệng Chống Oxy Hóa & Tảo Biển.

Chống Oxy Hóa & Tảo Biển.