-

Thanh toán đa dạng, linh hoạtChuyển khoản ngân hàng, thanh toán tại nhà...

Thanh toán đa dạng, linh hoạtChuyển khoản ngân hàng, thanh toán tại nhà... -

Miễn Phí vận chuyển 53 tỉnh thànhMiễn phí vận chuyển đối với đơn hàng trên 1 triệu

Miễn Phí vận chuyển 53 tỉnh thànhMiễn phí vận chuyển đối với đơn hàng trên 1 triệu -

Yên Tâm mua sắmHoàn tiền trong vòng 7 ngày...

Yên Tâm mua sắmHoàn tiền trong vòng 7 ngày...

- Publisher:401k Essentials (March 8, 2017)

- Language:English

- Paperback:300 pages

- ISBN-10:0996813020

- ISBN-13:978-0996813020

- Item Weight:1.9 pounds

- Dimensions:8.5 x 0.68 x 11 inches

- Best Sellers Rank:#872,664 in Books (See Top 100 in Books) #2,583 in Human Resources & Personnel Management (Books)

- Customer Reviews:5.0 out of 5 stars 2Reviews

Mô tả sản phẩm

Product Description

If you are the individual assigned the responsibility for the internal operation of a 403(b) plan or you are part of an organization overseeing a 403(b) plan, you need this book! Written in plain English, this book simplifies the operational aspects of a 403(b) plan. Don't underestimate the knowledge you must have to operate such a plan. There are many tasks, deadlines, roles and procedures that are required to ensure plan compliance with the Internal Revenue Service and Department of Labor. 403(b) Essentials For The ERISA Plan will educate and guide you in understanding the plan's administration and compliance requirements. The book is thorough, easy to read and provides the details needed to become familiar with terminology, operations, deadlines, processes, forms, and so much more. Use it as a resource and reference book. Use it as a training tool for you, the Payroll and HR departments and the Board of Directors. Financial advisors may also gain a glimpse into the inner workings of the plan.

About the Author

Barbara Klein, the founder of 401k Essentials, has 40 years experience in the retirement plan industry. Her breadth of knowledge and experience crosses through many of the retirement plan industry roles. Barbara's diverse background includes working for the government (Social Security Administration), an insurance company, a pension software firm and a third party administration firm. She is a frequent speaker and educator within the pension industry.

In addition to operating 401kEssentials.com, Barbara owns and operates a third party administration firm in Santa Barbara, California. Accrued Benefit Administrators, Inc. (ABA), operating since 1991, is a full service retirement plan administration firm specializing in qualified retirement and welfare benefit plans. The firm administers all types of retirement plans including - defined contribution and defined benefit plans such as 401(k), 403(b), profit sharing, simple, cash balance and many others. ABA is a TPA firm.

Barbara is a credentialed pension professional with the designations: Qualified Pension Administrator (QPA) and Qualified 401(k) Administrator (QKA) from the American Society of Pension Professionals & Actuaries and the American Retirement Association.

Professionally, Barbara is a member of the American Society of Pension Professionals & Actuaries, the National Institute of Pension Administrators, the Society of Human Resource Management, National Association of Women Business Owners, Provisors, the Professionals in Human Resources Association, the Santa Barbara Human Resource Association, and the Western Pension & Benefits Conference.

Barbara has won many awards, including most recently the prestigious 2013 Spirit of Entrepreneurship Award and the 2010 Best Small Business - Family Business &Closely Held Company Award. She has also been recognized with two Paul Harris Fellow awards for her contributions to Rotary International through her Service Above Self practices.

- Mua astaxanthin uống có tốt không? Mua ở đâu? 29/10/2018

- Saffron (nhụy hoa nghệ tây) uống như thế nào cho hợp lý? 29/09/2018

- Saffron (nghệ tây) làm đẹp như thế nào? 28/09/2018

- Giải đáp những thắc mắc về viên uống sinh lý Fuji Sumo 14/09/2018

- Công dụng tuyệt vời từ tinh chất tỏi với sức khỏe 12/09/2018

- Mua collagen 82X chính hãng ở đâu? 26/07/2018

- NueGlow mua ở đâu giá chính hãng bao nhiêu? 04/07/2018

- Fucoidan Chính hãng Nhật Bản giá bao nhiêu? 18/05/2018

- Top 5 loại thuốc trị sẹo tốt nhất, hiệu quả với cả sẹo lâu năm 20/03/2018

- Footer chi tiết bài viết 09/03/2018

- Mã vạch không thể phân biệt hàng chính hãng hay hàng giả 10/05/2023

- Thuốc trắng da Ivory Caps chính hãng giá bao nhiêu? Mua ở đâu? 08/12/2022

- Nên thoa kem trắng da body vào lúc nào để đạt hiệu quả cao? 07/12/2022

- Tiêm trắng da toàn thân giá bao nhiêu? Có an toàn không? 06/12/2022

- Top 3 kem dưỡng trắng da được ưa chuộng nhất hiện nay 05/12/2022

- Uống vitamin C có trắng da không? Nên uống như thế nào? 03/12/2022

- [email protected]

- Hotline: 0909977247

- Hotline: 0908897041

- 8h - 17h Từ Thứ 2 - Thứ 7

Đăng ký nhận thông tin qua email để nhận được hàng triệu ưu đãi từ Muathuoctot.com

Tạp chí sức khỏe làm đẹp, Kem chống nắng nào tốt nhất hiện nay Thuoc giam can an toan hiện nay, thuoc collagen, thuoc Dong trung ha thao , thuoc giam can LIC, thuoc shark cartilage thuoc collagen youtheory dau ca omega 3 tot nhat, dong trung ha thao aloha cua my, kem tri seo hieu qua, C ollagen shiseido enriched, và collagen shiseido dạng viên , Collagen de happy ngăn chặn quá trình lão hóa, mua hang tren thuoc virility pills vp-rx tri roi loan cuong duong, vitamin e 400, dieu tri bang thuoc fucoidan, kem chống nhăn vùng mắt, dịch vụ giao hang nhanh nội thành, crest 3d white, fine pure collagen, nên mua collagen shiseido ở đâu, làm sáng mắt, dịch vụ cho thue kho lẻ tại tphcm, thực phẩm tăng cường sinh lý nam, thuoc prenatal bổ sung dinh dưỡng, kem đánh răng crest 3d white, hỗ trợ điều trị tim mạch, thuốc trắng da hiệu quả giúp phục hồi da. thuốc mọc tóc biotin

KHUYẾN MÃI LỚN

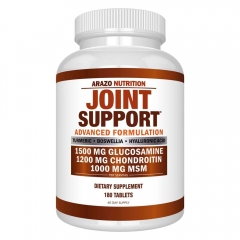

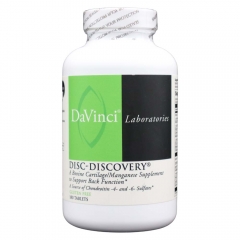

KHUYẾN MÃI LỚN Hỗ Trợ Xương Khớp

Hỗ Trợ Xương Khớp Bổ Não & Tăng cường Trí Nhớ

Bổ Não & Tăng cường Trí Nhớ Bổ Sung Collagen & Làm Đẹp

Bổ Sung Collagen & Làm Đẹp Bổ Thận, Mát Gan & Giải Độc

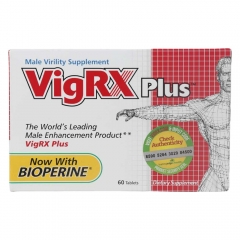

Bổ Thận, Mát Gan & Giải Độc Chăm Sóc Sức khỏe Nam Giới

Chăm Sóc Sức khỏe Nam Giới Chăm Sóc Sức khỏe Nữ Giới

Chăm Sóc Sức khỏe Nữ Giới Chăm sóc Sức khỏe Trẻ Em

Chăm sóc Sức khỏe Trẻ Em Thực Phẩm Giảm Cân, Ăn Kiêng

Thực Phẩm Giảm Cân, Ăn Kiêng Bổ Sung Vitamin & Khoáng Chất

Bổ Sung Vitamin & Khoáng Chất Bổ Tim Mạch, Huyết Áp & Mỡ Máu

Bổ Tim Mạch, Huyết Áp & Mỡ Máu Bổ Mắt & Tăng cường Thị lực

Bổ Mắt & Tăng cường Thị lực Điều Trị Tai Mũi Họng

Điều Trị Tai Mũi Họng Sức Khỏe Hệ Tiêu hóa

Sức Khỏe Hệ Tiêu hóa Chăm Sóc Răng Miệng

Chăm Sóc Răng Miệng Chống Oxy Hóa & Tảo Biển.

Chống Oxy Hóa & Tảo Biển.